For diabetes and EVs, removal is better than addition

Magrathea produces magnesium, which can help lighten EVs, instead of increasing battery size. I like this approach, the startup's low business risk, and what looks to be a fun attitude!

Questions

How can manufacturers produce more EVs while scaling mining more slowly?

What are the technology and business risks of Magrathea?

Why has the founder of an LFP cathode startup invested in Magrathea?

Background

According to the Energy Information Administration (EIA), the number of light-duty electric vehicles (EVs) globally will increase from 9 million in 2020 to nearly 700 million in 2050 (Fig. 1). Building hundreds of millions of new EVs requires tens of millions of tons of battery materials (lithium, cobalt, nickel, etc.). New mining ventures often require more than a decade to produce minerals at scale. Observers expect a shortage of these minerals in the coming years. Battery manufacturers like CATL and even automakers like Tesla have used vertical integration to ensure a steady supply of these minerals. At the same time, startups like Mitra Chem (founded in 2021 and raised $87M) have focused on other battery chemistries, such as iron-based cathodes instead of cobalt-based ones, partly to circumvent this mineral shortage.

These efforts are helpful and necessary, but they have all focused on optimizing the “electric” part of EVs. What about optimizing the “vehicle” part? American cars are heavy and getting heavier. Magrathea (founded in 2022 and raised $12M) addresses this challenge by producing magnesium, which can be used to create lighter structural aluminum and steel alloys. The company calls this approach “dematerialization.” Alex Grant, the founder and CEO of Magrathea, noted that dematerialization “is technology innovation focused on ‘doing more with less’ by, for instance, achieving higher economic output per mass of natural resources consumed.” He added that using this metal can “eliminate up to 75% of dead weight from some metal parts used in vehicles.” I like Magrathea because I like i) this philosophy, ii) their low business risk, and iii) their fun attitude!

In a complex system, try removal before addition

Nassim Taleb (Black Swan, Antifragile, Skin in the Game, etc.) is one of my favorite non-fiction writers and thinkers. His work often deals with the complexity of decision-making within large and disorderly systems. In a chapter called “Naïve Intervention” in Antifragile, he discusses how doctors can avoid Iatrogenesis, which are the negative side effects of medical interventions. In a lecture at Stanford as part of the book tour, he said,

Sometimes curing people is much easier to do by subtraction… All these rules are positive. They say, ‘Do this, do this, do this.’ Charlatans have typically nothing but positive rules. People who are scientists or philosophical have negative rules: ‘Don’t do this. Don’t do that.’ It’s much more rigorous actually, and they don’t have side effects… For example, remove cigarettes from society… It’s more effective than anything we are spending on drugs, and cumulatively more than anything done since penicillin… [or] if you remove corn sugar. … The first thing they do is try to give you a drug [for diabetes], instead of removing [sugar]… But pharma doesn’t make any money removing things from your system… This is the problem.

Interventions are often necessary to solve problems. However, interventions that consist of adding new elements to a complex system can have significant unknown side effects. A more robust solution would be to remove problematic elements from the system. This “negative” intervention would be much less likely to cause harmful side effects.

The global supply chains for structural metals and battery materials are also highly complex. Manufacturers’ response to the global demand has been to mine and process ever more iron and aluminum for structural metals, and cobalt, nickel, and lithium for EV batteries. This voracious appetite has led to environmental damage and human rights abuses in different countries. Magnesium-based alloys require less steel and aluminum for the same strength, which makes them lighter. A lighter vehicle can also operate on a smaller battery for the same driving range. In addition, Magrathea extracts magnesium from ocean water, which is much less invasive than mining hard rock. Solving mobility challenges by reducing the amount of structural and battery metals used in EVs is like treating a diabetic by removing sugar from their diet (Fig. 2). I think this philosophy is a truly innovative approach, and it is one of the main reasons I like Magrathea.

Magrathea has a low business risk

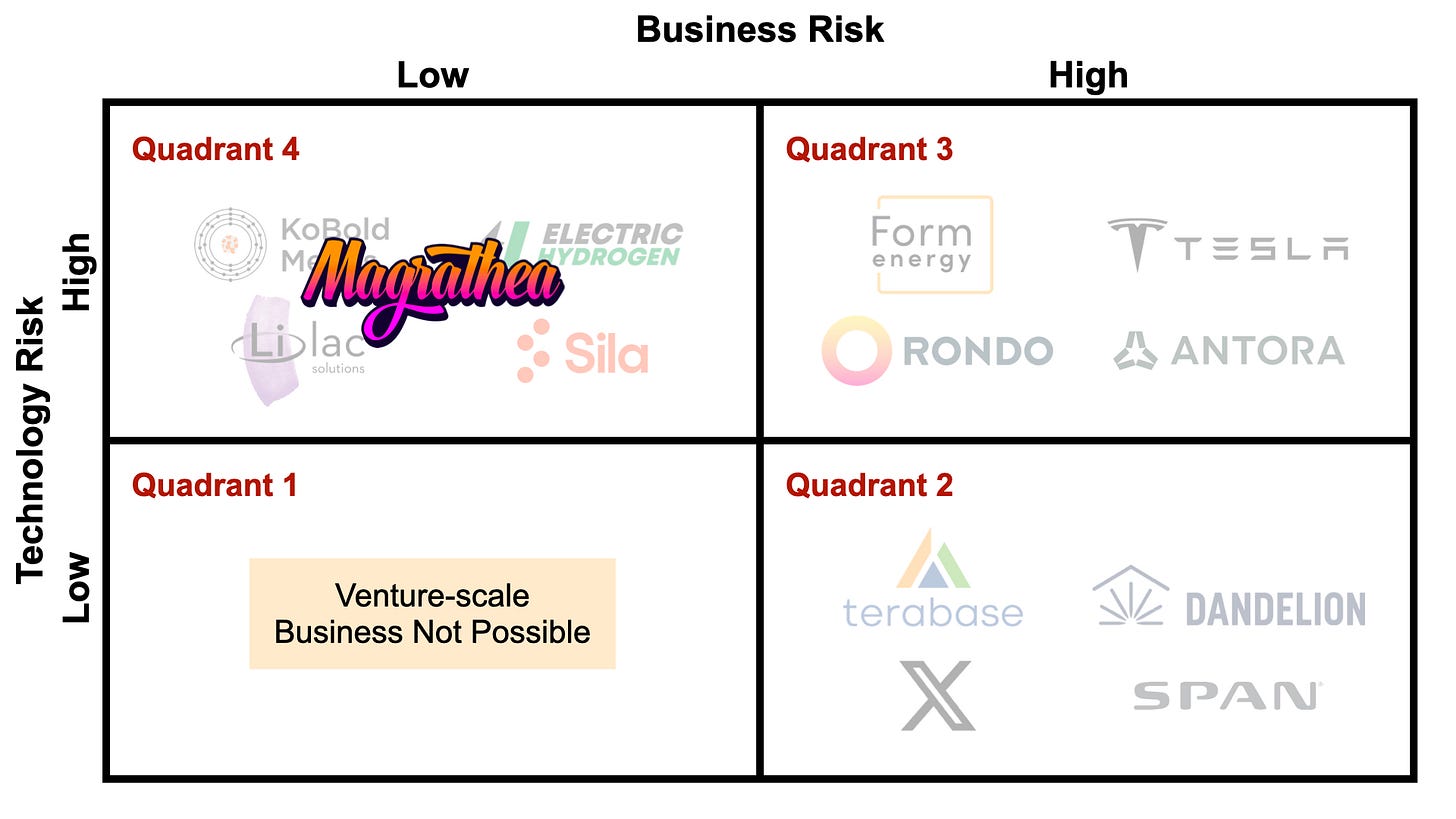

I have previously written about the technology and business risks faced by startups in the energy transition. Much like the other materials companies that I analyzed in that piece, Magrathea is a Quadrant 4 company facing high technology and low business risks (Fig. 3). I like this risk profile because of my experiences as an entrepreneur and venture capitalist. I generally dislike business risk, because it means that the company can execute perfectly over multiple years to build a great solution, but then realize that there is no market for that solution. Technology risk can be unpredictable and time-consuming, but startups pursuing very large markets can still have successful exits even if their timelines inevitably slip by multiple years.

According to Business Wire, the global “magnesium market was valued at $4.37B in 2021, and the market size is estimated to reach $6.36B by 2028.” This market size is respectable and roughly equivalent to the global markets for lithium ($5B) and cobalt ($8B). However, Magrathea is making a much bigger implicit bet. It is betting that the shortage of raw battery materials will make magnesium-based structural metals a much more common component of mobility in the future and that this market will be significantly bigger down the road. I think that is a reasonable bet.

Vivas Kumar, the CEO and co-founder of Mitra Chem, which is building lithium iron phosphate (LFP) batteries, has personally invested in Magrathea. One potential reason for this decision is that LFP cathodes offer a lower energy density and a shorter driving range compared to cobalt-based (NMC and NCA) cathodes. This fact has historically kept LFP cathodes out of the most high-end and high-performance applications. A significantly lighter vehicle means automakers can use LFP batteries across their fleet without sacrificing driving range, expanding Mitra Chem’s market.

Alex Grant previously co-founded the direct lithium extraction company Lilac Solutions, where he gained experience with brine mining. In a white paper published in Light Metal Age, he noted that producing magnesium from brine, “involves four main steps: hydrometallurgy, dehydration, electrolysis, and metal foundry.” Magrathea’s main innovations are likely in the dehydration and electrolysis steps, as the other steps are not differentiable. The information online is limited, so I would be curious to find out what is their actual technology innovation. Does this innovation lend itself to a continuous improvement that builds a technology moat? Instead, do they plan to build a moat with highly efficient operations and economies of scale?

From what I gather, it seems like the company used their $2M angel round to build a proof of concept. It then raised a $10M seed round led by Capricorn. Capricorn is a top-tier deep tech VC that likes to see working prototypes before investing. Alex Grant’s previous experience, the existence of a working prototype, and the involvement of Capricorn are all positive signs regarding Magrathea’s technology.

Magrathea looks like fun!

Magrathea’s website looks completely different from other deep tech startups. Other websites tell the visitor “We are nerds building something difficult” or “We are altruists saving the planet.” I think Magrathea’s website tells the visitor, “Pssst! Let me tell you a strange secret. Isn’t this cool? Weee!!!” The yellow, pink, and purple hues of the website remind me of the thematic colors of the video game Grand Theft Auto: Vice City (Fig. 4). The name Magrathea itself is a reference to The Hitchhiker’s Guide to the Galaxy, a book I mostly heard about as an undergraduate engineering student. At least from the outside, the company has an air of youthful enthusiasm. I feel that many people who think about the climate only have a mindset of concern. They do not always acknowledge that this work can be fun! I am glad that Magrathea is injecting a more enthusiastic energy into this effort.

A song I like

Now here you go again, you say you want your freedom Well, who am I to keep you down? It's only right that you should play the way you feel it But listen carefully to the sound of your loneliness

A scene I like

Gunnery Sergeant Hartman: “Private Joker is silly and he is ignorant, but he's got guts. And guts is enough.”