Think like a VC: technology and business risks in the energy transition

All venture-scale startups face significant risks. Successfully executing against those risks unlocks enormous market value.

Questions

How do venture capitalists (VCs) analyze the risks associated with technology startup investments?

How do startups prevent competitors from taking over their markets?

What do startups with low business and high technology risks have in common in the energy transition?

Background

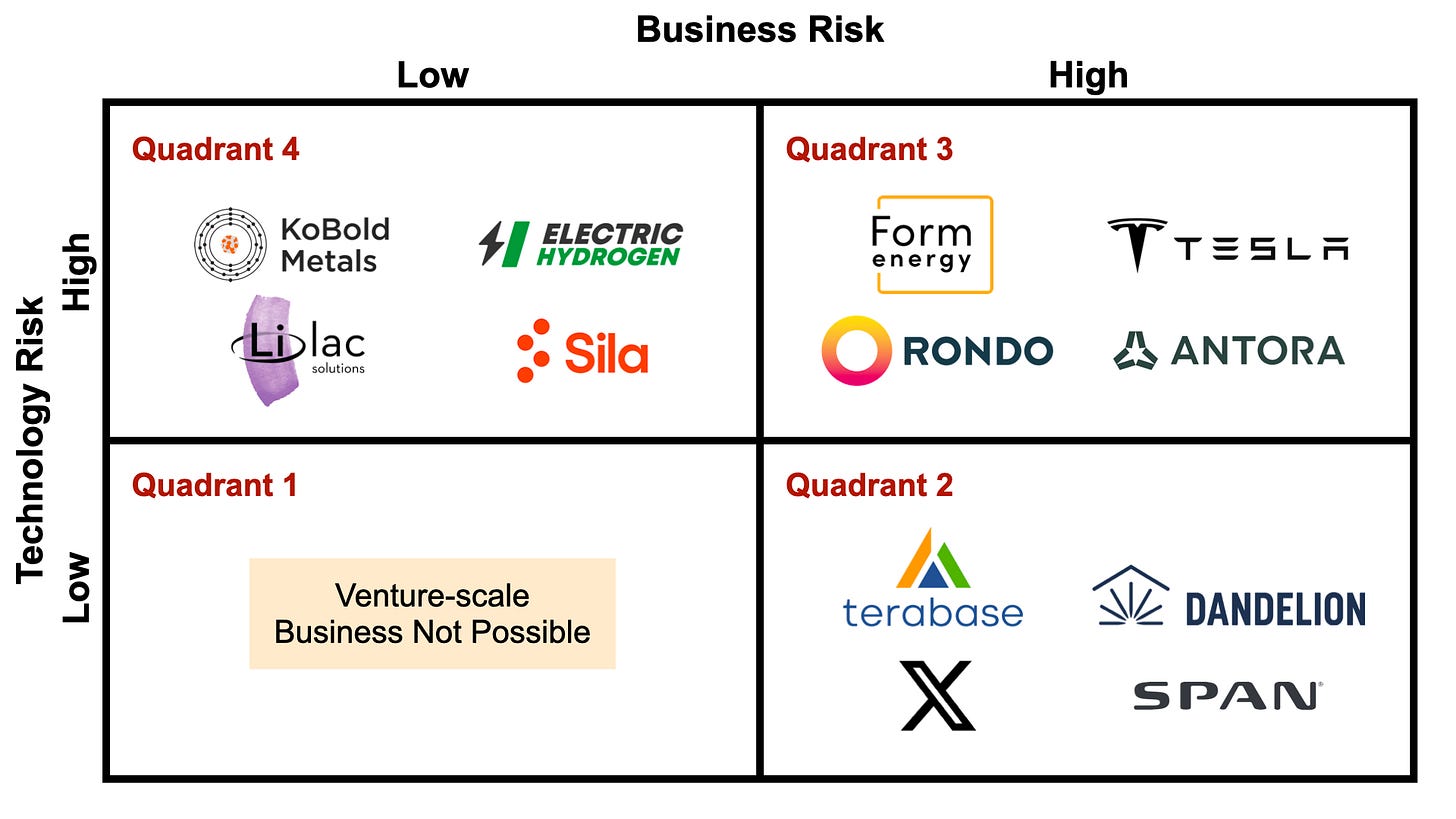

Entrepreneurs or VCs often consider two forms of risk: technology risk and business risk. Technology risk is roughly, “Can I build it?”, and business risk is roughly, “If I build it, will people buy it?” Technology startups in the energy transition can also be placed on these axes (Fig. 1).

To my knowledge, it is not possible to build a technology startup that faces neither of those risks. Otherwise, there are many examples of successful companies that have faced any combination of those risks. The investment theses of VCs sometimes bias them towards certain types of risk. For example, I have heard some investors say that they invest in companies with low technology risk, and others claim that they prefer low business risk. Those preferences sometimes relate to the expertise, network, or other resources that the VCs have for derisking the investment. Entrepreneurs should be aware of those theses and preferences, and focus on fundraising from firms that align with their businesses.

Employees may also have preferences for joining companies that face particular types of risk. They may have this preference for two reasons. First, the type of risk faced by a company relates to the types of work most valued by the company. For example, a researcher would likely find the work available in quadrants 3 and 4 companies to be most rewarding. On the other hand, a product manager would likely find the work in quadrant 2 companies to be the most engaging. Second, employees are some of the biggest shareholders (and by extension investors) of venture-backed startups. Just as VCs may have a preference for the type of investment risk that they take on, so should the potential employees.

Quadrant 1: Low Business and Technology Risks

As far as I know, it is not possible to build a venture-scale startup in this quadrant. It often takes 7-10 years to build a successful software startup, and it can easily take twice as long to build a “deep tech” company. Entrepreneurs and investors take enormous risks to build and fund such companies. However, if they are successful they can build a monopoly in a multibillion-dollar market. This new business forms a monopoly by building a “moat” around its market, to keep away competitors.

This moat is based on factors relating to the startup’s business, technology, or both. For example, for the past two decades, Google has had a monopoly in the highly lucrative online search business, where it holds a 90% market share. Google’s technology moat is based on the algorithms underlying its search engine, which provide some of the most relevant results for each query. Google’s business moat is its brand name recognition. We even use the phrase “Google” as a verb to mean online search. It is very difficult for a new startup to build effective algorithms and a brand name to gain market share from Google. The greatest threat to date has come from Microsoft Bing, which has a radically new technology (ChatGPT) and a strong brand name of its own. Peter Thiel’s Zero to One provides the best explanation of this principle that I have read.

It is not possible to build a venture-scale startup in the first quadrant because it is not possible to build a moat around the new company. The type of risk that a startup takes and the type of moat that it builds are nearly synonymous. If a startup does not take the necessary risks to build a moat, then any incumbent or newcomer can easily encroach on its territory by cutting prices. As the proverb goes, “Nothing ventured, nothing gained.”

Quadrant 2: High Business and Low Technology Risks

The technologies in this quadrant are not “easy.” However, they are difficult in relatively predictable ways. That predictability makes the endeavor low-risk. The technology work in this quadrant is primarily in the form of engineering, and building features that have been already built before in a different context. However, the business risk in this quadrant can be unpredictable. There is generally no evidence that customers would be willing to adopt such a product in large numbers, and more importantly, that they would be willing to pay for it. The right combination of these factors is called product/market fit (or even product/market/sales fit).

Twitter

I have included Twitter as an outlier among companies involved in the energy transition. I did so to point out how network effects are the dominant form of a business moat that the most famous Silicon Valley startups have built over the past 15 to 20 years. These companies include social media (Twitter, Facebook, TikTok, Snapchat, etc.) as well as two-sided marketplaces (Uber, Airbnb, DoorDash, Etsy, etc.). Being a member of one of these services is valuable because everyone else we know is on these services. That fact makes competing services that have fewer members less valuable. Instagram launched Threads in July 2023 to compete directly with Twitter. They started working on this project in January, and launched the app six months later, which is further evidence that Twitter did not have a technology moat. At the same time, Instagram leveraged its own 2.5 billion users to overcome Twitter’s network effects. Threads gained 100 million users within five days.

Terabase Energy

Terabase offers an integrated suite of software tools to developers and operators of solar power plants to reduce their costs. Building these tools is not a high-risk proposition. However, knowing which tools to build to gain rapid industry adoption, and then getting integrated into the plant’s Supervisory Control and Data Acquisition (SCADA) from the beginning is an effective moat against competitors. Their customers will find it difficult to change all of the systems where Terabase’s product has been integrated, and train their workforces on a different platform. Using multiple system integrations and significant user adoption as a business moat is similar to the strategy of Microsoft Office for maintaining market share.

Dandelion Energy

Dandelion helps homeowners replace their heating and cooling units with geothermal heat pumps. Their primary technology innovation is in better calculating the length of the ground loop required for their units (Fig. 2). Much like Amazon, their moat is mainly operational. They own the equipment used for drilling holes for the ground loop, and they employ the workers who install these systems. Finally, they work with banks to provide financing to their customers, and their size and track record allows their customers to benefit from very favorable rates. Any new entrant into this market would find it difficult to compete with Dandelion’s economies of scale or provide similar financing terms. Originally, Dandelion was built as a two-sided marketplace to connect homeowners with independent contractors who could install geothermal units for them. This model had some success; however, they realized that they could improve user adoption if they employed the workers and provided the full installation service. This kind of iterative product discovery is common for companies in quadrant 2, which can relatively easily change their product offerings to better meet customer needs.

SPAN

SPAN provides smart electrical panels that help with the monitoring and management of electricity production, storage, and usage at home. The technologies that it has developed are useful and easy to understand, but they do not represent a technology moat. SPAN has built integrations with battery systems and relationships with distributors, neither of which provide a significant business moat. I believe that SPAN’s main business moat is its seamless operation, design, and above all brand. SPAN has many of those features in common with Apple (Fig. 3). Apple has built a reputation as a luxury brand with beautiful and useful products that function seamlessly. The iPhone is not competing with Samsung on megapixels or processor speed, but on providing a delightful user experience. While doing so, it is capturing half of smartphone sales revenues globally, and a whopping 85% of profits! Those profit margins are only possible because of its position as a luxury brand. A few years ago, it even hired the head of the luxury clothing brand Burberry to help revamp its physical and online stores.

SPAN is following a similar strategy in building a branding moat. The interview that Arch Rao, the founder and CEO of SPAN, gave the Watt It Takes podcast provides further evidence. The company built an early version of its product within a year using its $3.5M seed financing round. Companies with high technology risk generally require multiple years, and one to two orders of magnitude more funding to reach that stage. At the same time, SPAN spent a sizable portion of that funding on hiring an industrial design firm. As Arch explained in that episode:

It's very unusual for a seed-stage company, with a few single digit millions in the bank, to go spend money with an external industrial design company. But from the very beginning it was super important to us to build a… hardware and software product that was stunning, and I think we’ve achieved that.

SPAN’s look, feel, and brand are a significant part of its business moat. As Apple has shown, such a moat can be quite effective.

Quadrant 3: High Business and Technology Risks

Startups in this quadrant are building technologies that require a significant amount of scientific invention or are very difficult to scale. Furthermore, these companies are generally creating new products or markets that did not exist before. Therefore, there is no evidence that customers are willing to buy such a product, how much they are willing to pay for it, and what features the product must have to make it valuable. These same business risks exist in quadrant 2 as well. However, in quadrant 3 entrepreneurs commit to building a technology for years before knowing whether there will be any customers. At the same time, successful quadrant 3 startups can create enormous new markets with significant technological and business barriers to entry for competitors.

Tesla

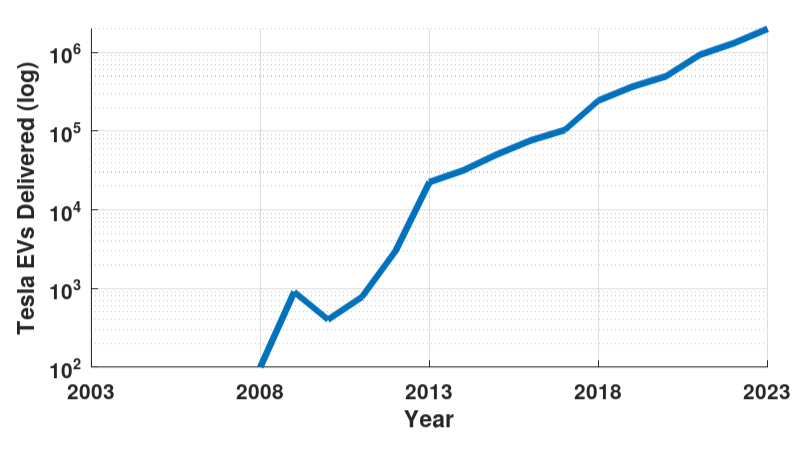

Tesla is a famous quadrant 3 company. There was no electric vehicle industry before Tesla was founded in 2003. There were no direct sales figures that the founders could use to determine the market size or pricing for each vehicle. The adjacent internal combustion engine (ICE) vehicles industry provided clues in terms of price, expected range, features, or potential market size. However, all of these components were merely educated guesses before the company built the vehicles and consumers started buying them. There was also an enormous technological and scaling challenge involved in chasing this uncertain market. Five years after its founding, the company launched the Roadster in 2008 and sold 100 units that year. A decade after its founding, Tesla launched the Model S in 2012 and sold 3,000 vehicles in that year (Fig. 4). In 2023, two decades after its founding, Tesla is expected to deliver up to 2 million vehicles, and it is valued at nearly one trillion dollars! Tesla’s founders took on significant technology and business risks, and their success created a lucrative new market, where their company is one of the leading figures.

Form Energy

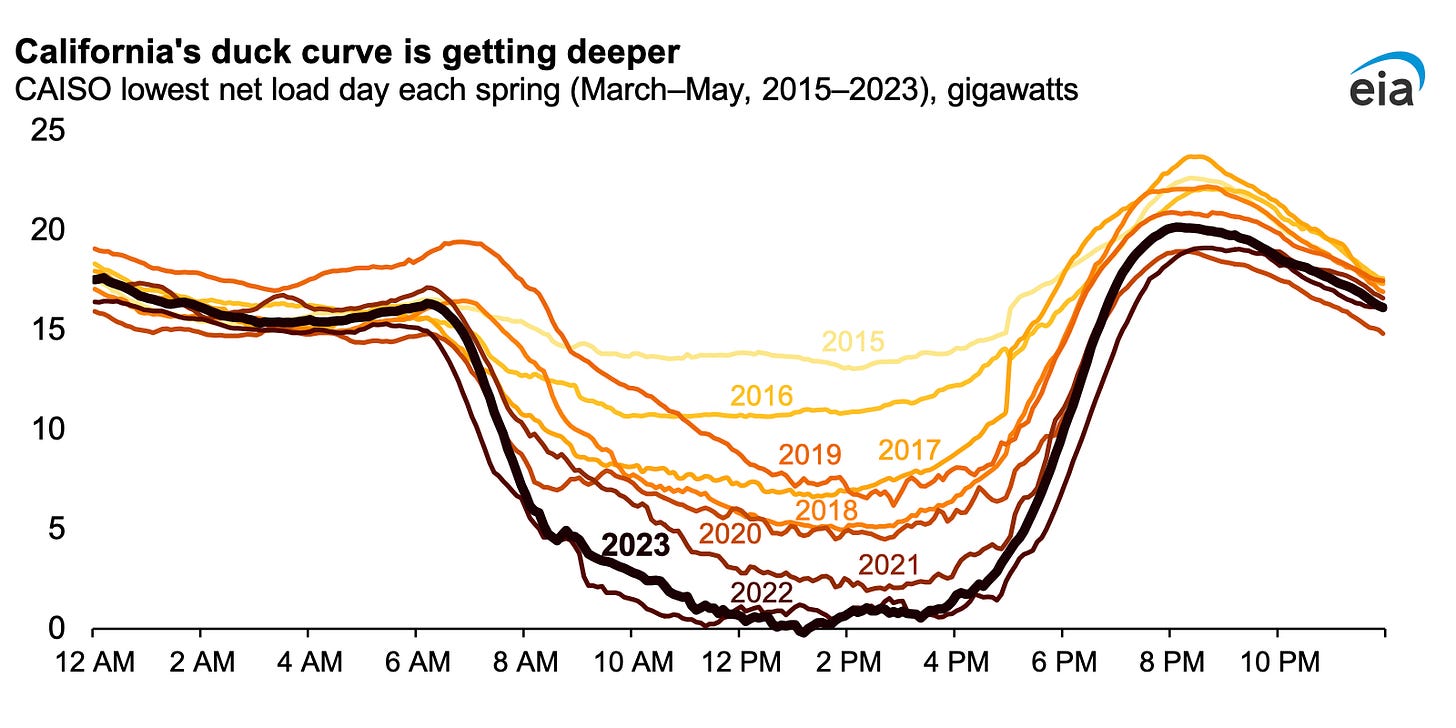

Form provides long-duration (100 hours) grid-scale storage of electricity. In what analysts have called a “duck curve,” the load on California’s power generation drops markedly in daytime hours while solar energy is plentiful (Fig. 5). This load increases suddenly in the evening as the sun sets and demand increases. As the grid adds more intermittent renewables like solar and wind, long-duration storage will most likely be necessary to smooth the swings in supply and demand, and increase resiliency. Form is placed in this quadrant because of its relatively high technology and business risks. An electrochemical storage unit of this magnitude has never been built before. Form needs to prove that it can achieve this scale reliably and repeatably. On the business side, there is currently no significant market for long-duration grid-scale storage technologies. The adjacent market for “peaking plants” or customer conversations may help with product specifications or pricing. However, the only true evidence of market demand is when customers pay for the product. While these risks are significant, a successful launch and scaling effort will create an entirely new industry where Form will have technological and business barriers to entry against future competitors.

Rondo Energy and Antora Energy

Like Form, both Rondo and Antora are involved in storing intermittent electrical energy. While Form stores electrochemical energy, Antora and Rondo store thermal energy and help industrial companies use this energy as process heat. Antora stores the heat in graphite blocks, and Rondo does so in bricks. Similar to Tesla and Form, Rondo and Antora also face higher technology and business risks, but with an important difference. Internal combustion vehicles and peaking plants could provide a helpful template for Tesla and Form’s products and markets, respectively. Process heat has different requirements in various industries like food and beverage, cement, or steel making. Furthermore, in most cases, the heat is part of the plant, and not an external product or service. In addition, grid operators do not need to make significant changes to their systems to source or sink electrical energy from a Form battery. Whereas, factories need to make capital investments in their operations in order to source their process heat from a thermal battery. The lack of direct market references and the greater difficulty in integrating thermal batteries into ongoing operations increase the business and technology risks of Rondo and Antora compared to Form. However, as with other venture-backed companies, building or accessing large markets is only possible through taking risks.

Quadrant 4: Low Business and High Technology Risks

Much like the companies in quadrant 3, quadrant 4 companies also face an uncertain R&D and technology scaling path to profitability. However, companies in this quadrant know that if they are successful, there is an existing multi-billion (or multi-trillion!) dollar market awaiting them. It is interesting to note that all of the companies from Fig. 1 in this quadrant are materials companies. They are all aiming at existing markets, where the buyer, product specifications, price, and competition are well-known. The challenge for these companies is to produce this known product with higher performance (Sila), lower cost (Electric Hydrogen), or in greater abundance (KoBold and Lilac).

Sila Nanotechnologies

Sila is replacing the graphite used in lithium-ion battery anodes with silicon to increase the energy density of these devices by 20%. Sila surrounds the silicon particles with a nanostructured material to absorb the 300% (!!!) swelling of lithium-saturated silicon. Sila’s commercial product, Titan Silicon, is a one-to-one drop-in replacement for graphite. According to Business Wire, “the global graphite market was valued at $24B in 2022 and is expected to grow to $38B by 2028.” Founded in 2011, Sila has needed more than a decade to engineer a product at scale that is substantially better than the incumbent, which was a significant technology risk. However, the company has faced low business risk, as it was aiming for a large market with established product specifications and buyers.

Electric Hydrogen

Electric Hydrogen (EH2) is building a new generation of electrolyzers that can produce hydrogen from water electrolysis at prices comparable to Methane Steam Reforming (MSR). There is already an enormous market for hydrogen as a feedstock for the petrochemical and fertilizer industries, and this market can grow much larger if hydrogen takes on a bigger role in transportation. According to Business Wire, “the global hydrogen generation market value surged from $148B in the year 2021 and is expected to reach $279B by the year 2030.” While EH2 technically sells hydrogen-producing machines instead of hydrogen, they often repeat their metric of interest as $/kg of H2. The product and the market for hydrogen are understood well. The main question for EH2 is whether it can produce hydrogen at a scale and cost that allows them to capture a significant share of this market.

Lilac Solutions and KoBold Metals

Lilac is mining for lithium in brine, and KoBold is mining for lithium, cobalt, nickel, and copper in hard rock. These metals are used as raw materials for electrification and for building lithium-ion batteries. The markets for lithium ($5B), cobalt ($8B), nickel ($36B), and copper ($291B) are already quite large. An additional $15 trillion of these metals are required by 2050 to meet world demand (Fig. 6). Once again, there is little risk that these companies will take on years of R&D effort to produce a product without any buyers. However, they each face a significant challenge in successfully scaling their technological and operational efforts to capture a major portion of this enormous market.

This is a really good article in terms of risks and protections.

Something important to note is that we are beginning to take a much more limited, albeit much more realistic, position around the potential uses of clean H2.

A great author to follow in this regard is Michael Liebreich, if you don't follow him already.

https://www.liebreich.com/the-clean-hydrogen-ladder-now-updated-to-v4-1/

Loved this article and the simplicity you took to categorize the businesses! Keep up the good work!